Trust have increasingly become a preferred way of structuring assets. ZICO Trust Singapore recognises the importance of the legal relationships and obligations

involved for those intending to set up trusts.

Trusts originated in England, and therefore English trust law has had a significant influence, particularly among common law legal systems such as the United States and the countries of the commonwealth.

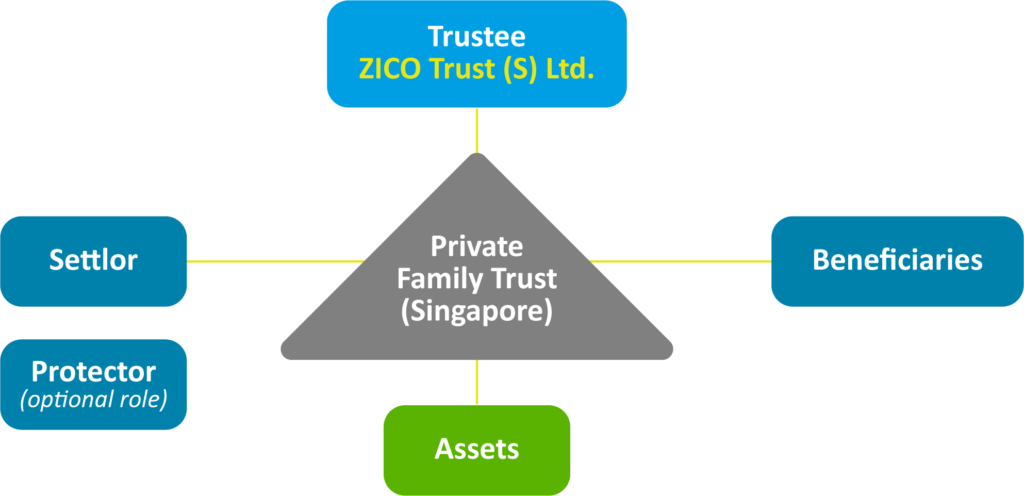

Singapore continues to make itself the choice for wealthy individuals who wish to establish trust arrangements for their families. The country’s reputation as a progressive international financial centre and its business-friendly environment has ensured that its wealth management and trust industry will see rapid growth in the coming years.

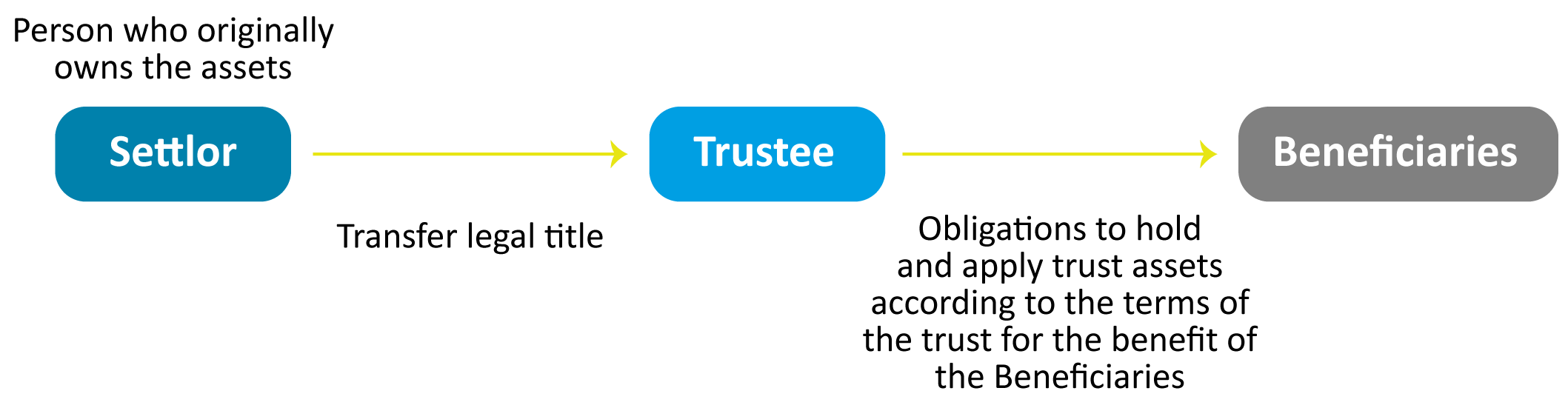

A trust is a legal arrangement whereby the ownership of a property is divided between two parties, such that one person is entrusted with the legal title to the property (the trustee) whilst another person (the beneficiary) retains the beneficial (or equitable) ownership of the property. The original owner of the property who creates the trust arrangement (the Settlor) would enter into this arrangement in order to allow the trustee the control to manage and administer the property, whilst being assured the economic benefits from the property will accrue to the beneficiary.

A private family trust is usually designed to help a high net-worth individual preserve assets and facilitate the transfer of assets to future generations. Trusts provide continuity in the administration of assets, especially if a company (as opposed to a specific individual) is chosen as the trustee. A properly setup trust ensures protection of assets and can provide continuity of benefits to family members across generations.

Parties to a Trust include the Trustee, Settlor, Beneficiaries and Protector (optional role). The Settlor can appoint or nominate anybody to be a beneficiary as he desires which can also include himself but not as a sole beneficial owner.

The following 3 certainties are required in order for the Trust to be valid:

- Certainty of intention to create a trust. There must be a clear intention to create a trust. The person creating the trust, be it the Settlor (in the case of a living trust) or the testator (in the case of a testamentary trust) must clearly express in the trust deed or his Will (as the case may be) that it is his intention to create a trust.

- Certainty of subject matter (Asset or Property of the Trust). It is a requirement that the subject matter be certain — that the property intended to be vested in the trust be separated from other property.

- Certainty of the objects of the Trust (Refer to Beneficiaries). A trust must have beneficiaries. A trust is not valid, if it has no beneficiaries, or if the identity of the beneficiaries is uncertain and cannot be determined. Beneficiaries can be anyone of the Settlor’s choice and need not be related to the Settlor[1].

[1] Note: For a trust in which a Private Trust Company acts as trustee, the beneficiaries essentially have to be related by blood or adoption.

Common types of Trust include Discretionary Trust, Reserved Investment Powers Trust, Insurance holding Trust and Standby Trust (this list is not exhaustive).

A Trust set up by way of a Will written by the Settlor and effective upon the demise of the Settlor. Whereas, a Living Trust is set up by way of a Deed of Settlement during the lifetime of the Settlor.

A Standby Trust is a type of Living Trust set up during the lifetime of the Settlor. It is dormant until such time assets are poured into the Trust, commonly by way of Will upon the Testator’s demise.

A trust can be one of the effective legal ownership tools in order to manage the Settlor wealth more efficiently and to certain extent, provide a good financial and legacy planning.

- Wealth protection is a major advantage of private trusts. Since the trustee is the legal owner of the assets, the Settlor relinquishes his rights. In most cases, this ensures a form of protection against creditors, bankruptcy, exchange controls, hostile governmental authorities and other risks such as a matrimonial asset battle in the event of a divorce.

- Confidentiality, trusts can be established offshore (outside of the Settlor’s home country) and privately, thereby ensuring confidentiality of the Settlor. Furthermore, when the Settlor passes away, the trust assets would not be dealt with under any probate proceedings.

- Succession Planning can be managed by setting up trusts, which alleviates concerns of forced heirship legislations, such as those imposed by Civil and Shariah Law. Trust arrangements empower the Settlor to decisively appoint the beneficiaries of their assets. Also, in the event of death, lengthy probate processes can be avoided by setting up trusts during the Settlor’s lifetime. In case of bankruptcy of beneficiaries, the trust assets are protected and the beneficiaries are still assured of the income under the trust.

Tax savings are an important consideration for many wealthy individuals to choose to setup trusts in low tax jurisdictions. In the case of Singapore, there is no capital gains tax, estate duty tax or withholding tax imposed on the distributions to beneficiaries. There are also various income tax exemptions available to qualifying foreign and domestic trusts, including, the tax exemption on certain types of trust income of a foreign trust as well as its distributions to beneficiaries.

Any asset that legally belongs to the Settlor except those under joint ownership of which a written consent must be obtained from the joint owner.

From a Singapore law perspective, the relevant time is the period of five (5) years prior to the date of the bankruptcy application in which the individual is an adjudged bankruptcy. This is subjected to certain conditions and we strongly recommend to seek appropriate advice from a suitable independent qualified professional.

The trust can only be revoked or amended if the trust is a Revocable Trust.

A Revocable Trust allows the Settlor to amend and make changes or terminate the trust, whereas an Irrevocable Trust is a trust where Settlor does not have the ability to make any changes or amend. The Irrevocable Trust can only be terminated by transferring all assets or properties under the trust to the Beneficiaries.

Interest of such deceased Beneficiary can be dealt with accordingly under the terms of the Trust Deed.

In Singapore, a person is legally capable of holding a property upon attaining the age of 21. The Settlor may also specific a later date which is after the legal age and this should be expressly stated in the Trust Deed the age they should inherit.

In Singapore, Trusts created on or after 15 December 2004 can continue for a maximum period of 100 years. Subject to this new statutory rule against perpetuities, the duration of a trust is otherwise determined:

- According to the provisions in the trust deed

- When all the trust assets have been distributed to the beneficiaries

- When all the beneficiaries unanimously consent to the termination

No, the Trust Settlement is effective once it is executed by the Settlor and the trustee unlike a will. The properties or distribution under a trust are not subject to any order of court as they do not form part of the will therefore, the grant of probate or letters of administration is not required for the trustee to administer the trust assets

If the trust is managed by a professional trustee for example, a licensed trust company like us regulated by a regulatory body such as the Monetary Authority of Singapore (MAS), the trustee is bound to observe the terms of the trust deed and to the extent possible, administer the assets in accordance with the Settlor’s Letter of Wishes. In the case where the trustee is an individual, an abuse of power is possible as they would not be subject to same onerous regulations and expectations placed on professional trustees.

A letter of wishes is a non-legal binding document written by the Settlor of the manner in which he wishes the trustees to exercise their discretion in relation to a discretionary trust.

A letter of wishes provides guidance to the trustee to act in the best interest of the beneficiary(ies).

Questions?

Please feel free to get in touch with us if you have any additional questions.